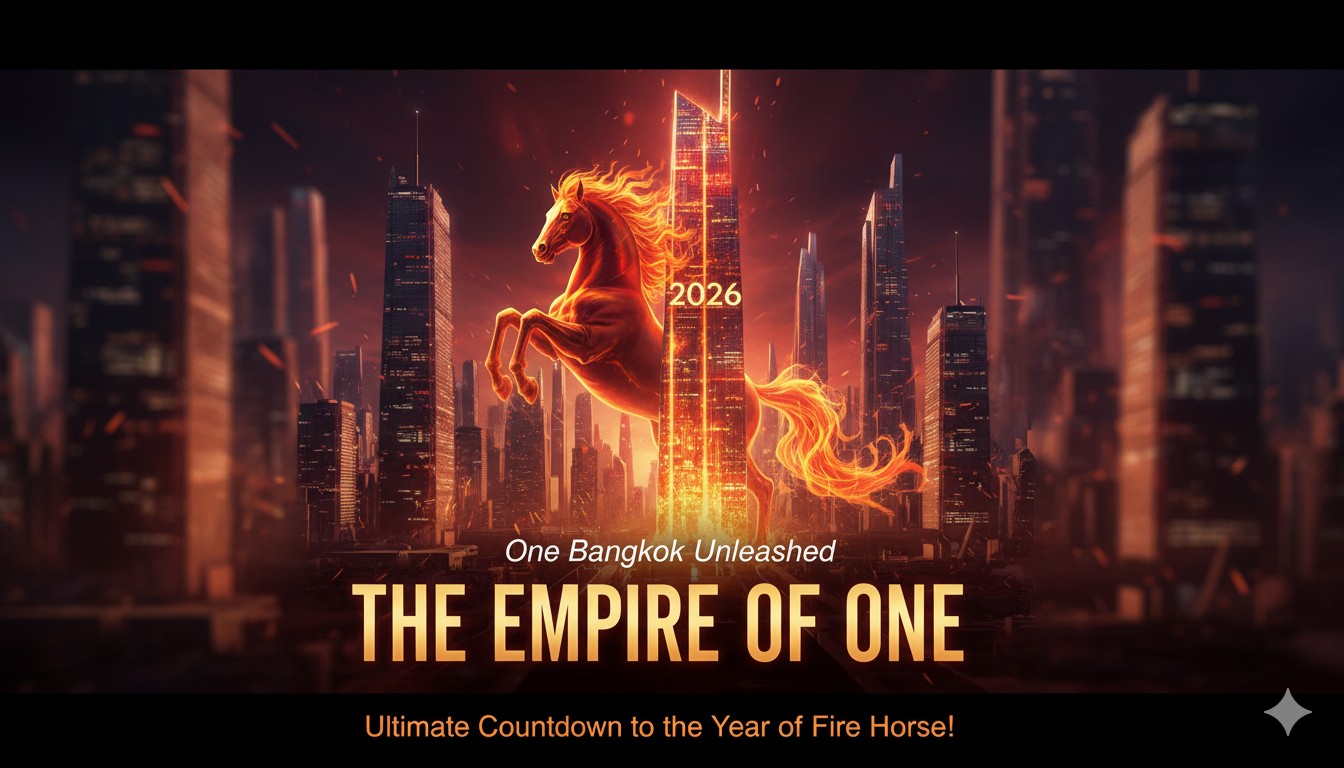

“One Bangkok’s $3.5 billion development shone brightly in its first major event, ‘The Empire of ONE,’ drawing massive crowds for a star-powered countdown to the Year of the Fire Horse, boosting tourism inflows and underscoring the project’s potential to generate billions in retail and hospitality revenue for Thailand’s economy.”

Investment Spotlight on One Bangkok

One Bangkok stands as Thailand’s largest private-sector property initiative, with a total investment exceeding $3.5 billion from joint venture partners focused on creating a 41-acre integrated district. This mega-project combines premium office towers, luxury hotels, high-end retail spaces, and residential units, positioning Bangkok as a competitive hub against regional rivals like Singapore and Hong Kong. The recent countdown event exemplifies how such developments leverage cultural spectacles to attract international capital, with early leasing rates in key towers reaching 80-85 percent, driven by demand from multinational corporations and affluent consumers.

Event-Driven Economic Boost

The ‘Empire of ONE’ celebration featured performances by international K-Pop sensations and top Thai artists, culminating in a drone-orchestrated light show and fireworks that symbolized prosperity in the Chinese zodiac’s Fire Horse year. This extravaganza not only filled the district’s venues but also stimulated immediate economic activity, with retail footfall surging by estimated double digits during the holiday period. For investors eyeing Southeast Asia, events like this translate to enhanced asset values—One Bangkok’s retail component alone is projected to contribute over $1 billion annually in gross leasable area revenue once fully operational, supported by partnerships with global brands.

Market Implications for Global Investors

| Key Financial Metrics for One Bangkok Project | Details |

|---|---|

| Total Investment Value | $3.5 billion USD |

| Development Area | 41 acres |

| Office Space Leasing Rate (as of Q4 2025) | 80-85% |

| Projected Annual Retail Revenue | Over $1 billion USD |

| Job Creation Potential | 50,000+ positions |

| Sustainability Investments | $200 million in green infrastructure |

Frasers Property, a key developer, saw its shares hold steady at 1.13 SGD (approximately 0.88 USD) in early January trading on the Singapore Exchange, reflecting market stability amid positive sentiment from the event’s success. This resilience highlights opportunities for U.S.-based funds interested in diversified real estate portfolios, as Thailand’s tourism sector rebounds with expected GDP contributions from visitor spending topping $50 billion in 2026. The Fire Horse year’s themes of vitality and transformation align with forecasts for 7-8 percent growth in Bangkok’s luxury property segment, fueled by inbound investments from Asia-Pacific players.

Strategic Positioning in Asia’s Real Estate Landscape

By hosting world-class events, One Bangkok elevates Bangkok’s appeal to high-net-worth individuals and corporate tenants, potentially increasing property yields by 5-6 percent annually. Comparable to U.S. developments like Hudson Yards in New York, this project integrates smart city features, including energy-efficient designs that reduce operational costs by up to 20 percent. For American investors, exposure through listed entities like Frasers offers a hedge against domestic market volatility, with dividend yields averaging 4 percent in recent quarters.

Disclaimer: This news report provides general information and tips based on publicly available sources; it is not intended as financial advice or a recommendation to buy, sell, or hold any securities.