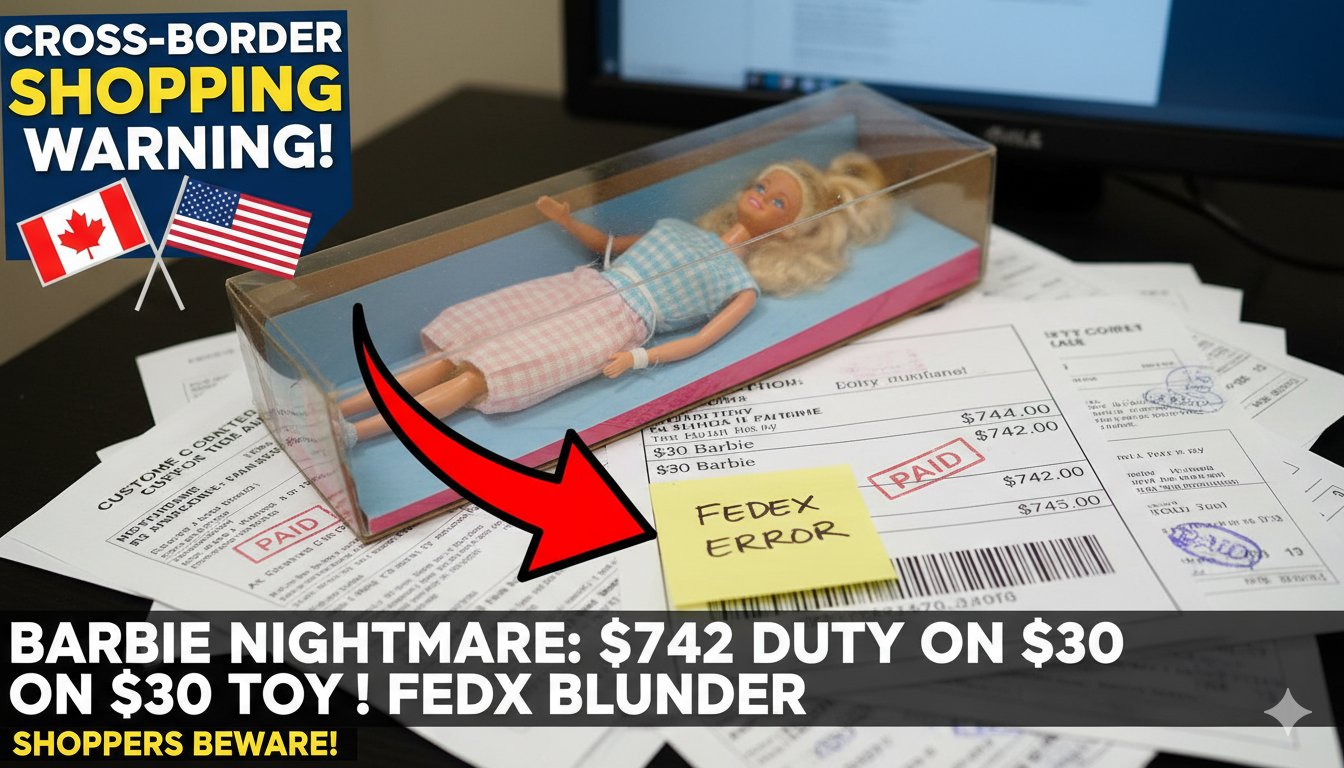

A Massachusetts resident received a $30 special-edition Barbie doll as a gift from a relative in Nova Scotia, Canada, only to be hit weeks later with an $802 invoice from FedEx for tariffs and fees. The massive charge stemmed from a paperwork mistake where the doll’s value was listed as nearly $3,000 CAD instead of $29.97 due to a misplaced decimal point. Converted to U.S. dollars (around $2,100), this triggered a 35% tariff of $742, plus additional brokerage and processing fees. While FedEx ultimately reversed the charge after intervention, the incident underscores the risks of new tariff policies, eliminated duty exemptions, and carrier handling errors that can inflate costs dramatically for everyday imports from Canada.

FedEx Clerical Blunder Turns $30 Gift into $802 Headache

Bonnie O’Connell, a Boston-area grandmother, wanted to surprise her granddaughter with a unique PWHL- and Tim Hortons-themed Barbie doll, a limited-edition item not easily available stateside. Priced at about $30 CAD (roughly $22–$30 USD depending on exchange rates), she asked her cousin in Nova Scotia to purchase and ship it south.

Under normal circumstances, small-value gifts or purchases might have cleared customs with minimal hassle. But recent U.S. trade policy shifts changed that landscape significantly. The administration imposed or raised tariffs on various Canadian goods, with non-compliant items (those not qualifying under the USMCA free trade agreement rules of origin) facing duties as high as 35%. Toys like dolls often fall into categories subject to these higher rates, especially if they don’t meet specific manufacturing thresholds for preferential treatment.

The cousin took the doll to a local FedEx location, where staff offered to handle the customs declaration paperwork. In the rush — with a line forming behind — a simple but devastating error occurred: the decimal point in the declared value was shifted two places to the right. What should have read $29.97 became effectively $2,997 CAD.

After currency conversion, U.S. customs assessed the shipment’s value at approximately $2,100 USD. Applying the 35% tariff rate yielded $742 in duties. FedEx tacked on brokerage and processing fees, pushing the total invoice to $802.

The package was delivered first without any upfront indication of the pending charge. Weeks later, the bill arrived, leaving O’Connell stunned. “I tend to do the right thing. If I get a bill, I pay it,” she said. “But not this time.” She questioned why FedEx would release the package if such a large amount was owed, and joked about the absurdity: “How many Barbies do you know that cost close to $3,000?”

Initially, FedEx indicated corrections could take months. After media involvement highlighted the obvious clerical mistake, the company reversed the charges and cleared her account.

Broader Implications for Cross-Border Shoppers

This wasn’t just an isolated mishap; it exposes systemic vulnerabilities in the current cross-border environment.

The elimination of the de minimis exemption — previously allowing shipments under $800 to enter duty-free with simplified paperwork — has dramatically increased scrutiny and costs for low-value imports. Even small packages now require full customs declarations, and carriers like FedEx, UPS, and others often bill recipients for duties, taxes, and their own handling fees after delivery.

For goods from Canada, the tariff picture is particularly complex:

Items qualifying under USMCA rules (e.g., substantial North American content and transformation) may enter at 0% or low preferential rates.

Non-qualifying goods face baseline tariffs, recently elevated in some categories to 35% amid trade tensions and policy adjustments.

Toys and consumer products frequently land in the higher-duty bucket unless specifically exempted.

Shoppers ordering from Canadian sites — whether for unique regional items, lower prices, or family gifts — now face unpredictable added expenses. Carriers may deliver first and bill later, creating “sticker shock” surprises. Errors in declaration amplify the problem, turning minor purchases into major disputes.

Key Risks and How They Add Up

Here’s a breakdown of how costs can escalate in similar scenarios:

Declared Value Error : Misplaced decimals, typos, or rushed entries can inflate valuations exponentially.

Tariff Application : 35% on non-preferential goods — e.g., $742 on a $2,100 assessed value.

Brokerage Fees : Carriers charge $10–$50+ for customs processing.

Additional Duties/Taxes : State sales taxes, merchandise processing fees, or harbor maintenance fees in some cases.

Total Multiplier : A $30 item can balloon to hundreds or thousands if values are misstated.

Cross-border families, e-commerce enthusiasts, and holiday gift buyers are particularly vulnerable. Sellers abroad report declining U.S. orders as customers balk at surprise fees or abandon carts. Some Canadian merchants absorb duties to retain business, but that’s unsustainable.

Practical Advice for U.S. Consumers

Scrutinize every customs form before signing, even if a carrier “handles” it. Verify declared values match reality. Consider paying duties upfront where possible to avoid delayed bills. For frequent cross-border purchases, explore USMCA-compliant sources or domestic alternatives to minimize exposure.

In an era of evolving trade rules, what once seemed like a simple international order now carries hidden financial pitfalls. One misplaced decimal turned a thoughtful gift into a nightmare invoice — a reminder that vigilance is essential when shopping across the northern border.

Disclaimer: This is a news report based on publicly available information. It is not financial, legal, or tax advice. Import duties and regulations can change; consult official sources or professionals for specific situations.