“The antimicrobial coatings industry is experiencing accelerated expansion as hospitals, public facilities, and consumer product manufacturers prioritize long-term surface protection against bacteria, viruses, and fungi. With a projected valuation of USD 12.5 billion by 2033 and a compound annual growth rate (CAGR) of around 9.2% from 2026 onward, the market benefits from silver-based formulations dominating applications while innovations in copper, zinc, and nanotechnology address durability and regulatory compliance.”

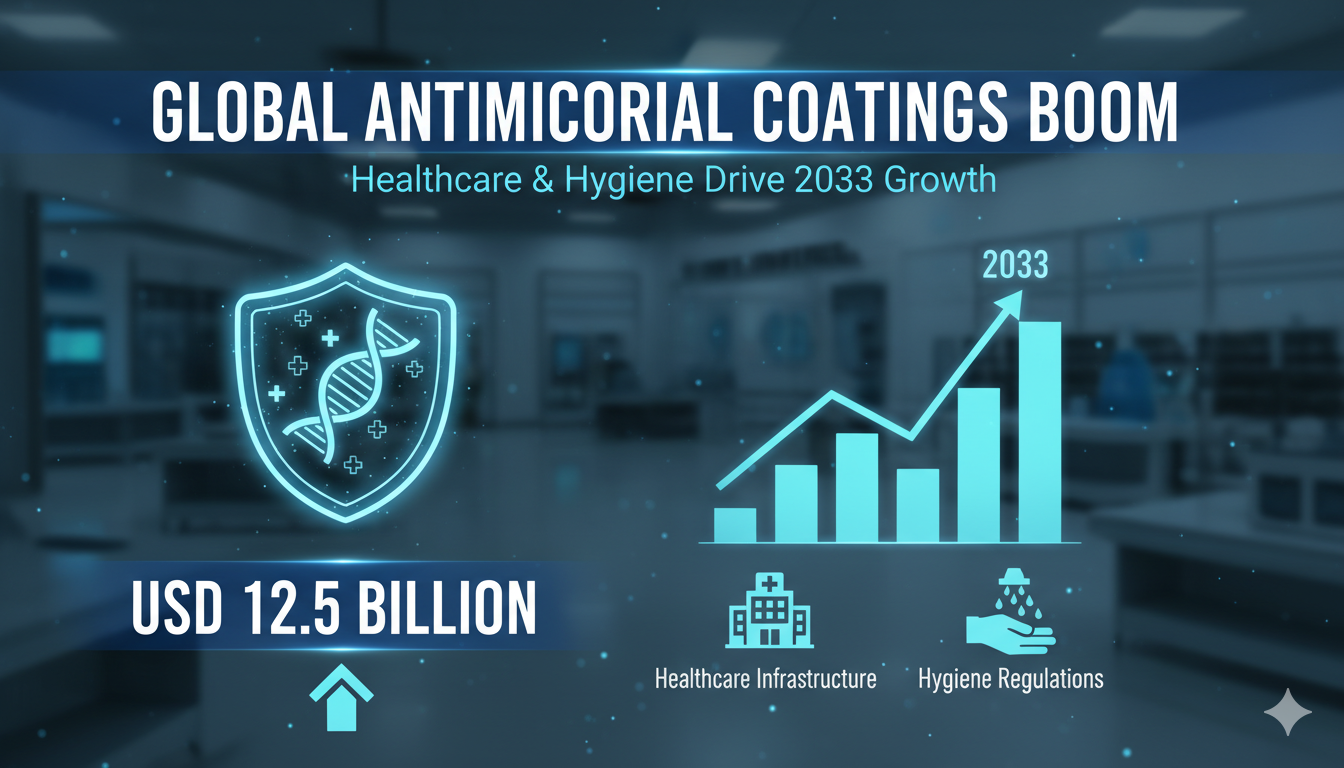

Antimicrobial Coatings Market Set for Steady Growth to USD 12.5 Billion by 2033

Healthcare facilities remain the largest end-use segment, where antimicrobial coatings are applied to high-touch surfaces such as bed rails, door handles, countertops, medical equipment, and HVAC systems to combat HAIs that affect millions of patients annually and drive up treatment costs. Recent expansions in hospital construction and renovation projects, particularly in North America and emerging markets, have boosted demand for these protective layers. Stricter hygiene regulations from bodies overseeing hospital accreditation and public health standards mandate enhanced infection prevention protocols, pushing adoption in both new builds and retrofits.

Beyond healthcare, the building and construction sector contributes significantly to market momentum. Architects and developers increasingly specify antimicrobial paints, powders, and films for commercial buildings, schools, airports, and residential complexes to maintain cleaner environments amid growing public concern over surface-transmitted pathogens. Powder coatings and liquid formulations incorporating active agents provide durable protection on walls, floors, and fixtures without compromising aesthetics or performance.

The food processing and packaging industry represents another key growth area. Antimicrobial coatings on equipment, conveyor belts, storage containers, and packaging materials help prevent bacterial cross-contamination, extend shelf life, and comply with food safety guidelines. As global supply chains emphasize traceability and hygiene, manufacturers turn to these solutions to reduce spoilage risks and meet export requirements.

In consumer goods and textiles, antimicrobial treatments are gaining traction in apparel, home furnishings, and everyday items like kitchen appliances and electronics. Silver nanoparticles and organic alternatives offer odor control and stain resistance, appealing to health-conscious buyers.

Material innovations shape competitive dynamics. Silver-based coatings continue to lead due to broad-spectrum efficacy and proven track record in medical settings, though concerns over long-term environmental accumulation prompt shifts toward copper, zinc oxides, quaternary ammonium compounds, and hybrid nano-formulations. These newer options provide sustained release mechanisms, better compatibility with substrates, and reduced toxicity profiles to align with tightening regulations in North America and Europe.

Application methods vary by end-use. Powder coatings dominate industrial and architectural uses for their durability and ease of application via electrostatic spraying, while liquid coatings suit medical devices and flexible surfaces. Aerosol forms enable quick touch-ups in public spaces.

Regionally, North America holds a commanding position thanks to advanced healthcare systems, rigorous EPA oversight on antimicrobial claims, and substantial R&D investment. The U.S. leads in adoption for hospitals and public infrastructure. Europe follows closely, driven by EU directives on biocidal products and emphasis on sustainable formulations. Asia-Pacific emerges as the fastest-growing region, fueled by rapid urbanization, healthcare modernization in countries like China and India, and expanding manufacturing bases for coated products.

Key challenges include balancing antimicrobial performance with environmental safety and cost considerations. Manufacturers invest in R&D to develop non-leaching, eco-friendly alternatives that maintain efficacy over extended periods. Regulatory scrutiny on active ingredients requires ongoing testing and certification, influencing product development timelines.

The market landscape features established players focusing on portfolio expansion through acquisitions and partnerships, alongside startups introducing specialized nano-enabled solutions. Collaboration between coating producers and substrate manufacturers accelerates integration into existing production lines.

Overall, the trajectory points to sustained demand as hygiene priorities become embedded in infrastructure planning, product design, and daily operations across industries.

Disclaimer: This is a news and market analysis report based on industry trends and projections. It is for informational purposes only and does not constitute investment, financial, or professional advice.